09/02/2025:

Tuesday Mortgage Memo: Your Weekly Market Highlights

5 KEY HIGHLIGHTS BROKERS NEED TO KNOW

With trade rulings, GDP shocks, and rate cut odds shaping this week’s sentiment, brokers have plenty of moving pieces to track. The combination of bond market volatility, sticky inflation, and legal challenges to U.S. tariffs means clients are looking for clarity more than ever. Here’s what you need to know:

1️⃣ Bond Yields Rise on Tariff Chaos

Canadian 5-year bond yields climbed to 2.95% this morning, pulled higher by U.S. Treasuries. The move follows a federal appeals court ruling that struck down most of President Trump’s tariffs, forcing the U.S. government to potentially refund billions. This legal blow rattled markets, pushing yields higher on both sides of the border.

Source:

RMG Morning Bru – Bruno Valko, Sept 2, 2025

🔑 Broker Strategy: Urge clients on the fence about fixed rates to act now. Even if tariff headlines cool, today’s yield spike could translate into lender rate hikes before week’s end.

2️⃣ Canada’s GDP Slumps While U.S. Inflation Stays Stubborn

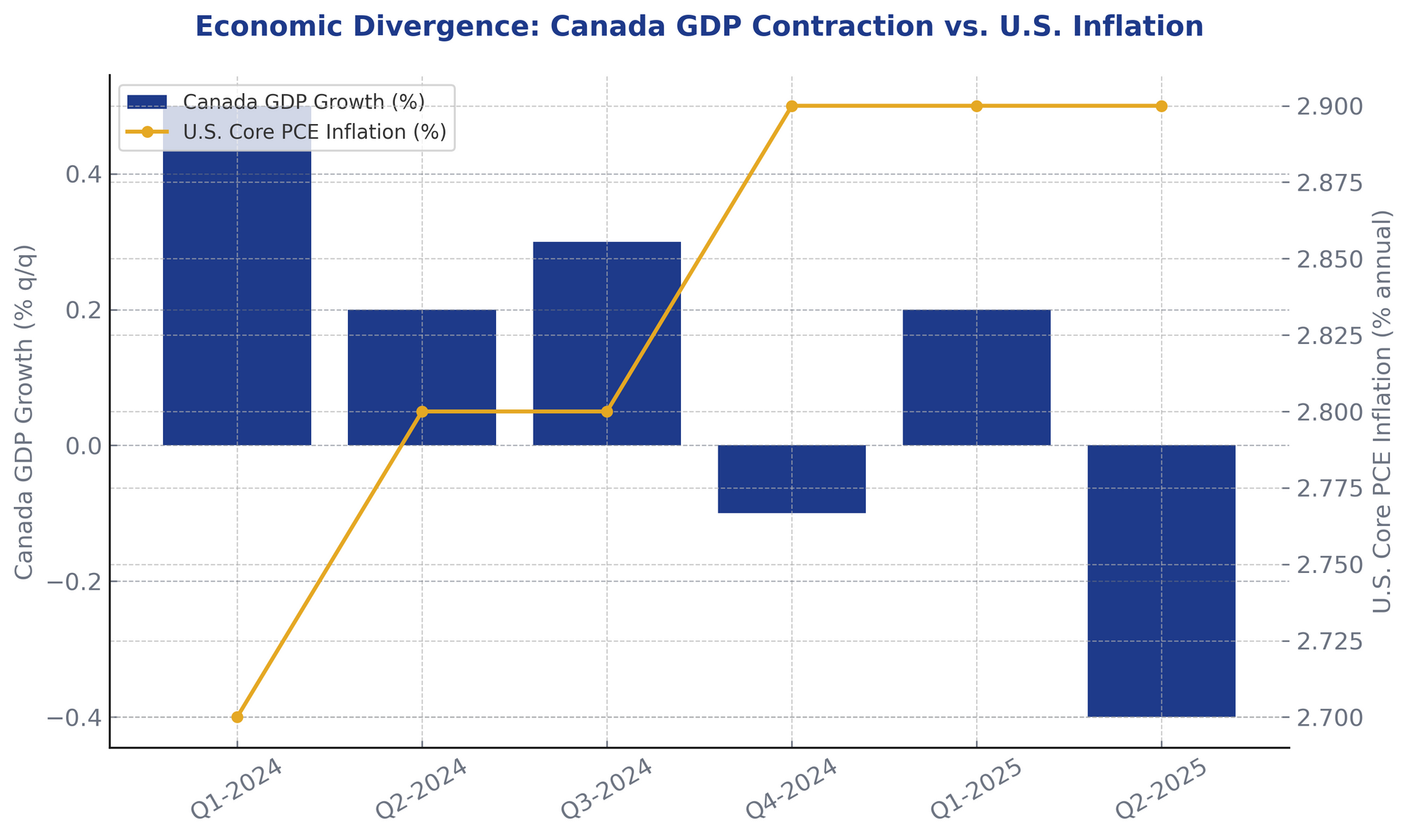

Canada’s Q2 GDP shrank by 0.4%, reversing earlier growth and contracting 1.6% annualized—driven by weaker exports and investment. By contrast, U.S. Core PCE inflation held at 2.9% in July, its highest in five months. This economic divergence could pressure the Bank of Canada toward easing even as the Fed remains cautious.

Source:

RRMG Morning Bru – Bruno Valko, Aug 29, 2025

A chart here can highlight Canada’s growth slowdown beside U.S. sticky inflation—underscoring the policy split brokers must watch.

🔑 Broker Strategy: Position this divergence as a window of opportunity. Short-term fixed options may remain stable in Canada even as U.S. policy delays cuts. Educate clients on how differing central bank paths could shape mortgage pricing.

3️⃣ Jobs Day Looms with Weak Forecasts

Friday’s job reports in both Canada and the U.S. will be pivotal. Consensus expects only 7,500 jobs gained in Canada and 75,000 in the U.S., with unemployment ticking up to 7% and 4.3% respectively. Markets are bracing for revisions that could swing sentiment sharply.

Source: RMG Morning Bru – Bruno Valko, Sept 2, 2025

🔑 Broker Strategy: Share a “watch alert” with clients. Stress how labor weakness could accelerate BoC cuts, creating better entry points for variable-rate borrowers.

4️⃣ Housing Crisis Debate Turns Toward 50-Year Amortizations

Industry voices are again spotlighting affordability fixes, with calls to extend amortizations to 50 years. Proponents argue longer terms can align payments with incomes, giving first-time buyers a foothold in a market that feels out of reach. Critics warn it only delays the affordability problem.

Source: The BTBB Sunday Blog Post – Aug 31, 2025

🔑 Broker Strategy: Use this debate as a client engagement tool. Acknowledge frustrations around affordability, but pivot toward practical solutions—rate holds, insured products, or refinancing strategies that create breathing room today.

5️⃣ Rate Cut Odds Soar Ahead of Sept 17 Decisions

Markets now see a 90% chance of a Fed cut this month and 50-50 odds for the Bank of Canada. With Canadian growth faltering and U.S. inflation sticky, policymakers face diverging pressures. Traders expect multiple cuts over the next six months, though timing remains uncertain.

Source:

RMG Morning Bru – Bruno Valko, Aug 29, 2025

🔑 Broker Strategy: Advise clients to lock in rate holds before Sept 17. For renewals, emphasize flexibility—shorter fixed terms or hybrids can bridge today’s uncertainty until policy directions clarify.

📢 Final Thought:

Between court battles on tariffs, GDP contractions, and inflation standoffs, the fall mortgage season is shaping up to be unpredictable. Brokers who can cut through the noise, simplify data for clients, and act decisively will stand out. The weeks ahead may deliver volatility—but also opportunity.

📢 Stay Informed, Stay Ahead!

These updates are a high-level summary. For deeper insights, subscribe to Mortgage Logic News via our ABW Agent Intranet under our corporate plan.

EPISODE 48: Behind the Broker with Danny Duong

Guest: Danny Duong

Danny Duong, Mortgage Architect at A Better Way Mortgage Group, brings nearly two decades of experience to this episode—centered on trust, authenticity, and client-first service. After starting in Human Resources and spending eight years as a mobile mortgage specialist with TD Bank, Danny transitioned into the broker channel in 2014 to better serve his clients’ needs.

He shares how he navigated the shift from institutional banking to entrepreneurial brokering—building a website, marketing himself, and learning the tools needed—one manageable step at a time with mentorship and support.

Danny’s approach to client relationships is marked by honesty and empathy. He listens attentively, provides clear roadmaps and service expectations, and isn’t afraid to tell a client to stick with their current bank if it’s truly their best option. That level of transparency builds deep, lasting trust.

Beyond business, Danny’s version of work-life balance is more about work-life harmony—stepping away when needed, blending work and family time thoughtfully, and staying responsive without losing presence.

Choose to Receive the ABW Memo

This is a choice-based resource. If you'd like to continue receiving these updates weekly, please register here:

Click here to subscribe to the ABW Tuesday Mortgage Memo

We look forward to helping you stay ahead of the market in 2025.